By Josh Shilts, CPA, ASA, ABV/CFF/CGMA, CFE

November 2, 2022

NACVA’s QuickRead

Identification First!

Few articles in the business valuation profession address the identification component of valuing goodwill, particularly personal or professional goodwill in the context of matrimonial dissolution matters. Current literature provides valuation professionals with techniques regarding the quantification or valuation exercise (e.g., cost approach, discounted cash flow, relief from royalty, etc.); however, this leaves professionals in some cases quantifying goodwill without determining what, if any, personal goodwill characteristics exist. This potential misstep may leave a valuation professional not addressing or identifying evidence to support that such an intangible asset exists. This article focuses on suggested practices to identify personal goodwill as well as discusses some of its unique characteristics.

Few articles in the business valuation profession address the identification component of valuing goodwill, particularly personal or professional goodwill in the context of matrimonial dissolution matters. Current literature provides valuation professionals with techniques regarding the quantification or valuation exercise (e.g., cost approach, discounted cash flow, relief from royalty, etc.); however, this leaves professionals in some cases quantifying goodwill without determining what, if any, personal goodwill characteristics exist. This potential misstep may leave a valuation professional not addressing or identifying evidence to support that such an intangible asset exists. This article focuses on suggested practices to identify personal goodwill as well as discusses some of its unique characteristics.

Valuation professionals may want to start their analysis with a review of IAS 38 for guidance. Intangible assets are defined as, “an identifiable non-monetary asset without physical substance. An asset is a resource that is controlled by the entity because of past events and from which future economic benefits (inflows of cash or other assets) are expected. [IAS 38.8]”[1]

Further, the three critical attributes of an intangible asset are (1) identifiability, (2) control (power to obtain benefits from the asset), and (3) future economic benefits (such as revenues or reduced future costs). An intangible asset is identifiable when it [IAS 38.12] (a) is separable (capable of being separated and sold, transferred, licensed, rented, or exchanged, either individually or together with a related contract) or (b) arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations. Further, IAS 38 requires an entity to recognize an intangible asset, whether purchased or self-created (at cost) if, and only if: [IAS 38.21] (a) it is probably that the future economic benefits that are attributable to the asset will flow to the entity; and (b) the cost of the asset can be measured reliably.[2]

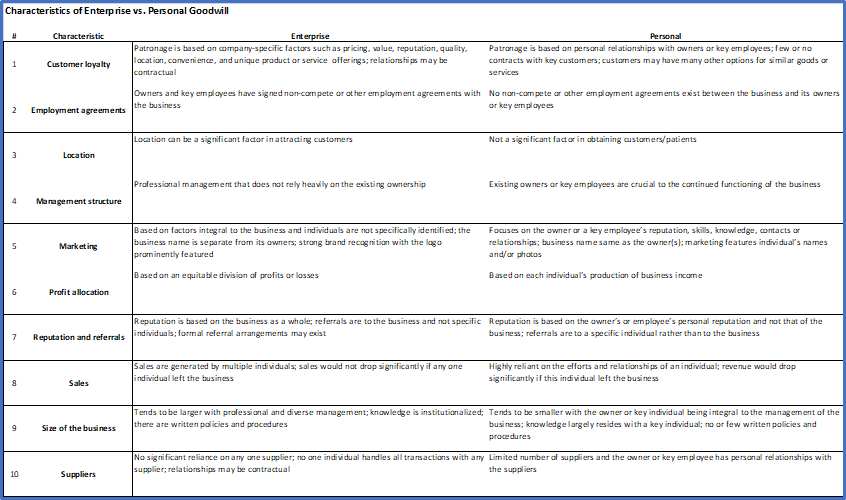

Valuation professionals may want to utilize the guidance from IAS 38 when identifying intangible assets; particularly, remembering the criterion regarding identifiability and recognizability. Those criteria, specifically in the context of IAS 38, can help the professional further support not only the valuation of personal goodwill, but more importantly the characteristics that it is in existence and there exists a “probable future economic benefit or a cost that can be readily measured”. One article that may help valuation professionals organize those characteristics, specifically in the context of a valuation in a marital dissolution action when personal or professional goodwill is in dispute, is Overview of Enterprise and Personal Goodwill, by Dr. Shannon Pratt.[3] Review of the article helped this appraiser identify various characteristics and allowed me to create a demonstrative to support the identification of personal or enterprise goodwill. The explanation is worded in such a way that the reader can elicit the type of asset by fully understanding the business and its uniqueness.

As can be seen in the exhibit, 10 business characteristics have been identified and descriptions for each are provided to review along with the analysis of the business to assess the business characteristic and if it has a personal or enterprise goodwill characteristic based upon the specific item (e.g., location, management structure, etc.). Thus, analyzing these characteristics while performing a valuation in compliance with Rev. Ruling 59-60, a valuation professional can provide evidence (i.e., tangible in the form of sales data or intangible/qualitative in the form of location assessment, etc.) to “validate” or “showcase” their personal vs. enterprise goodwill assessment that would support the value of any of those intangible assets. I have found in experience, that providing the men and women in black robes with a visualization or analogy to complement a valuation number helps that individual understand the enterprise and its combination of business assets and how they work together in conjunction.

Valuation professionals providing expert witness services in relation to personal vs. enterprise goodwill assessment may enhance or bolster their findings through explanation to the court of the business characteristics and how they lend themselves to the identification of either personal or enterprise goodwill. This step shows the trier of fact that not only has a number been provided, but thorough analysis has also been provided to determine if such an asset exists.

[1] IAS 38 – Intangible Assets. Deloitte IAS Plus.

[2] Ibid.

[3] Article noted in BVResources, Guide to Personal v. Enterprise Goodwill. 5th Edition.

[4] Property of Shilts CPA, PLLC.

The National Association of Certified Valuators and Analysts (NACVA) supports the users of business and intangible asset valuation services and financial forensic services, including damages determinations of all kinds and fraud detection and prevention, by training and certifying financial professionals in these disciplines.

Information contained in this article is provided for informational purposes only. It should not be misconstrued as legal or accounting advice or intended as a thorough, in-depth analysis of specific issues or a substitute for a formal opinion. It presents matters of general interest relating to business valuation, forensic accounting, and litigation support topics for educational purposes only. Shilts CPA, PLLC disclaims all liability concerning actions taken or not taken based on any or all of the contents of this article.

We would be pleased to perform the requisite research and provide a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation service.