Dear Clients, Colleagues and Friends,

Shilts CPA continues to provide individuals the business community with valuable tax, valuation and accounting information as it relates to the COVID-19 Pandemic and the CARES Act. Our professionals have been conducting webinars, working with national industry groups (AICPA), and advising clients and colleagues in various facets. As times have changed, our newsletter is changing too. In the future you will see more videos and infographics used to communicate information.

In the video above we discuss how, as a technologically forward Firm, we offer multiple ways for our clients to send us information securely and safely online. We hope you continue to be safe and remember to reach out to Shilts CPA with any questions related to tax and accounting services.

Some of the articles and content we want to make you aware of are

- SBA Borrowers’ Good-Faith Certification Q&A – The SBA has issued further guidance for recipients of PPP loans concerning the “economic uncertainty” certification.

- Additional Tax Deadlines Extended – Tax relief has now been expanded to include additional returns, tax payments, and other actions for all Americans including those living overseas.

- Employee Retention Credit Could Help Your Business – Businesses that have been financially impacted by COVID-19 may be able to take advantage of a new, refundable tax credit.

- Job Loss Could Affect Your Tax Situation – If you’ve lost your job you may have questions about how it could affect your tax situation. Here are some answers.

- Small Business: Tax Consequences of Crowdfunding – If you’re thinking of setting up a crowdfunding campaign to help your small business stay afloat, here’s what you need to know.

Tax Tips

Quickbooks Tips

Upcoming Events

The following are events Mr. Shilts will be speaking at. If you have questions or are interested in attending refer to the links below or contact us by clicking here.

- June 2, 2020 – Ocala/Marion County Chamber & Economic Partnership (CEP) will host a webinar by Mr. Shilts entitled “How to Complete the PPP Loan Forgiveness Application”

- June 25, 2020 – Business Valuation Resources will host a webinar by Mr. Shilts named “The Balance Sheet and its Correlation to Company Specific Risk” wherein the Balance Sheet is analyzed and used to support Company Specific Risk Premiums

- August 27, 2020 – The American Academy of Matrimonial Lawyers has asked Mr. Shilts to present on “The Valuation of Distressed vs. Impaired Companies”

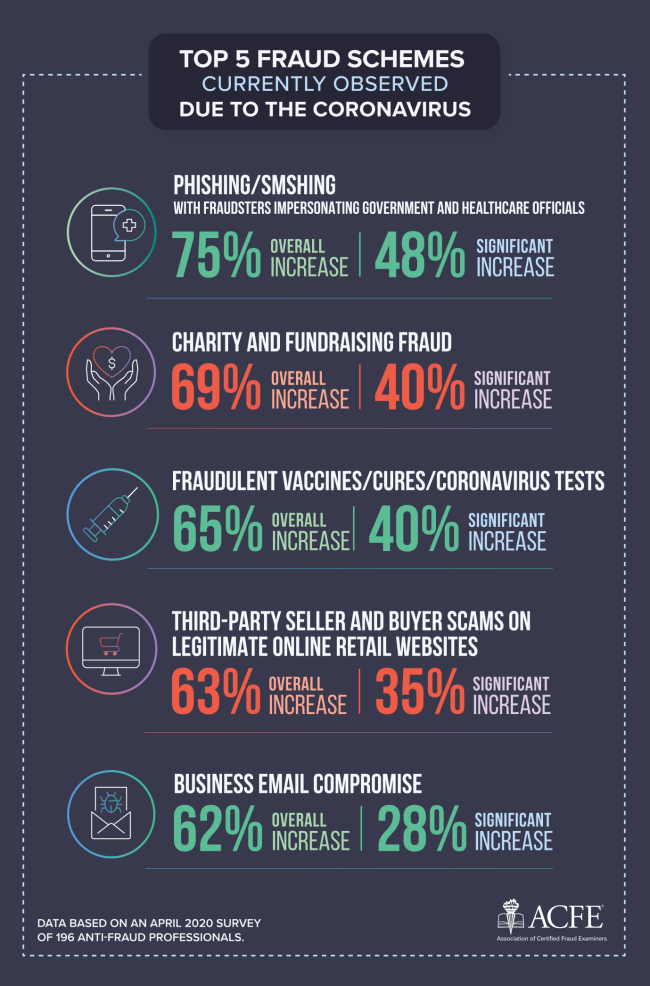

Fraud Schemes

Association of Certified Fraud Examiners (ACFE) issued the below infographic detailing the current observed Top 5 Fraud Schemes due to the Coronavirus.

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties. If desired, we would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services.