Dear Clients, Colleagues, and Friends,

Shilts CPA continues to provide the business community on valuable tax, valuation and accounting information as it relates to the COVID-19 Pandemic and the CARES Act. Our professionals have been conducting webinars, working with national industry groups (AICPA), and advising clients and colleagues in various facets. As times have changed, our newsletter is changing too. In the future you will see more videos and infographics used to communicate information.

We hope you continue to be safe and remember to reach out to Shilts CPA with any questions related to forensic and valuation services. As our article selection points out this month we believe we will see increases in Fraud, Bankruptcy, and Valuation services as a result of the Pandemic and its impact on the economy. In the “world” of valuation we believe the Firm will be called upon to assist other valuation firms on how to prepare and defend valuation conclusions in the current economic climate as well as assist high-net worth individuals taking advantage of the current economic environment for Gift Tax purposes.

Josh Shilts, CPA/ABV/CFF/CGMA, CFE

Some of the articles and content we want to make you aware of are

- The Association of Certified Fraud Examiners has created their own COVID-19 resource page. One of the interesting items found was the increase in fraud related schemes from the Pandemic. While phishing and other email schemes are prevalent the ACFE is projecting an increase in fraud schemes related to lending, directly attributed to the CARES act. A link to the info graphic can be found at the Firm’s LinkedIn

- Our President, Josh Shilts, recently published a FAQ with the AICPA. Mr. Shilts discussed COVID-19 and its market disruption as an example of a valuation uncertainty that is causing unprecedented impacts on the economy and industry. The Purpose of the FAQ was to provide valuation professionals with guidance in a “back to the basics” thought process as they struggle to define and calculate the impacts of the current economic unrest. In addition to this FAQ Mr. Shilts is chairing the AICPA’s BV Committees Task Force on the CARES Act wherein he is working with professionals across the country to provide guidance on its implications on valuation. The task force has identified the following components that may deserve consideration:

Other articles of interest

Upcoming Events

The following are events Mr. Shilts will be speaking at. If you have questions or are interested in attending refer to the links below or contact us by clicking here.

- May 14, 2020 – FL Bar’s Business Law Section’s Main Street CARES: Understanding Loans, Forgiveness and Tax Benefits for Businesses affected by COVID-19

- June 25, 2020 – Business Valuation Resources will host a webinar by Mr. Shilts named “The Balance Sheet and its Correlation to Company Specific Risk” wherein the Balance Sheet is analyzed and used to support Company Specific Risk Premiums

- August 27, 2020 – The American Academy of Matrimonial Lawyers has asked Mr. Shilts to present on “The Valuation of Distressed vs. Impaired Companies”

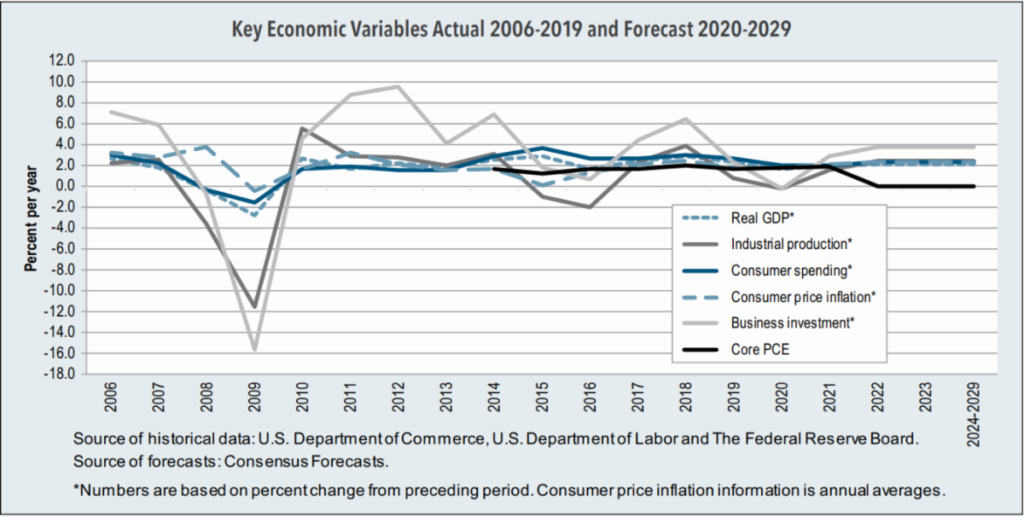

Economic Information

Any advice contained in this article, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion. If desired, we would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services.