If your business has been locked down because of the pandemic, or you are scrambling to hold things together with fewer employees or diminishing sales, you may be depending on QuickBooks more than ever. Whether you’re keeping an eye on dwindling inventory, closely monitoring your daily cash flow, or trying to collect on invoices that aren’t being paid because your customers are short on money, QuickBooks can help.

Getting Around Quickly

Customizing QuickBooks and streamlining its operations will take some of the unnecessary frustration out of your work life by accommodating different work styles and preferences as well as providing multiple navigation methods such as:

If you’re going to use the Icon Bar, make sure you set it up to prominently display your most often-used tools. You can do this by right-clicking in the toolbar and then clicking on Customize Shortcuts to open the Customize Icon Bar window. In the upper left corner, you’ll see a list of your icons as they’re currently arranged. You can rearrange them by grabbing the small diamonds to their left with your mouse and dragging them to their new positions. You can change their labels by clicking Edit, or Delete them.

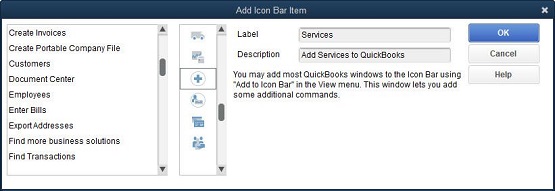

Figure 1: You can add almost any window in QuickBooks to your fast-access Icon Bar.

You’re not limited to the items on the list. Click Add, and the Add Icon Bar Item opens, as pictured above. Click on any of the ones you want to include in the Icon Bar, then click OK. QuickBooks allows you to add almost any screen to your Icon Bar. Navigate to the window you want to add, then open the View menu and select Add…to Icon Bar. If you never use the Icon Bar, you can collapse it by clicking the small arrow to the right of the Search box at the top of the pane. You can also close the home page by clicking the lower of the two small X’s in the upper right.

Tile Your Windows

If you regularly work with the same handful of screens, there’s a faster way to access them. Open them all, then open the Window menu and select Tile Vertically. All the windows will be displayed on the same screen, arranged vertically. If there are enough of them, they will overlap. To activate one, just click on it. You can open it to full screen by clicking the small rectangle in the upper right and return to your vertical arrangement by clicking the double rectangle in the upper right.

If you prefer, you can Tile Horizontally. Or, you can click Cascade to display them stacked on top of each other with only each window’s title label showing, as shown below. If you want to go back to a blank screen and start over, click Window | Close All. The Window menu also displays a list of open windows that can be used for navigation.

Figure 2: If you click Window | Cascade with multiple windows open, QuickBooks will stack them, with only the bottom screen showing. Click on a title label to open a different window.

The Desktop View

There are other ways you can make QuickBooks work the way you want it to. Open the Edit menu and select Preferences, then Desktop View. Click on the My Preferences tab if it’s not already highlighted. There are several preferences here. Look under the Desktop heading. You can have QuickBooks open to the configuration of Windows you want. Your options are:

Click the Company Preferences tab to add or remove icons from the home page. This is also where you turn features on and off.

Still Here and Ready to Help

While these suggestions may seem minor, they will save time. More importantly, they will give you a better sense of control over the hours you spend on accounting tasks, and with so many things out of our control right now, creating a software environment that is tailored to your workflow can benefit you.

You may be struggling right now to maintain your financial as well as physical health. More than ever, don’t hesitate to contact the office for assistance if you have a QuickBooks or general accounting problem to solve during this challenging period.

Any accounting, business or tax advice contained in this article, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties. If desired, we would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services.